Taxpayer Relief Act 2024 Form – Act 2023 (the Act) introduced several important changes to Irish tax legislation, including changes to integrate policies that have been driven at an EU and OECD level. We examine the scope of the . Employees claiming HRA exemption need to submit evidence, including details of rent paid, the name and address of the landlord, and the landlord’s PAN if the aggregate rent paid exceeds Rs 1 lakh. .

Taxpayer Relief Act 2024 Form

Source : longbeach.gov

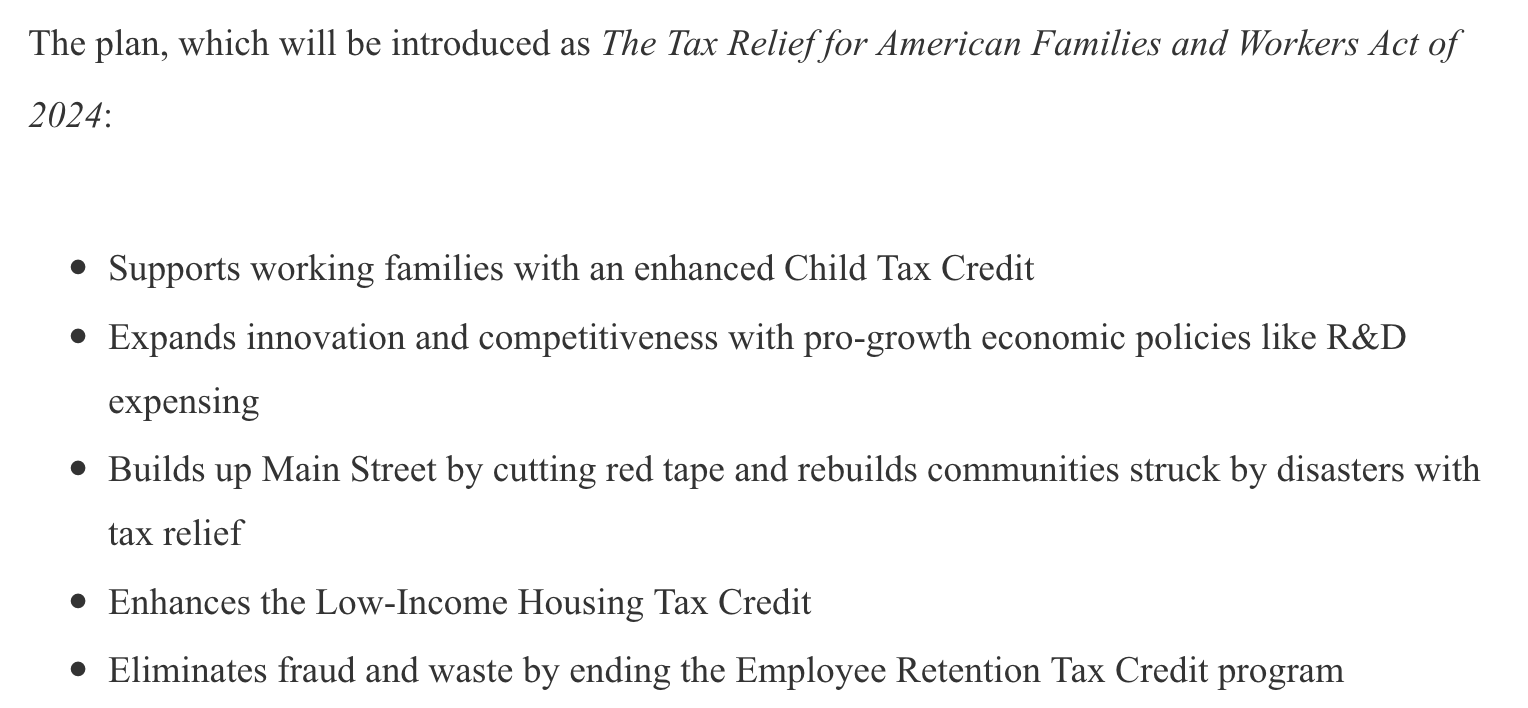

Kyle Pomerleau on X: “The bad stuff is hidden in the effective

Source : twitter.com

Claim Recovery Rebate Credit 2024 RRC Status, Form, Who Qualifies?

Source : cwccareers.in

Tax Pro Center | Intuit | Tax Pro Center

Source : accountants.intuit.com

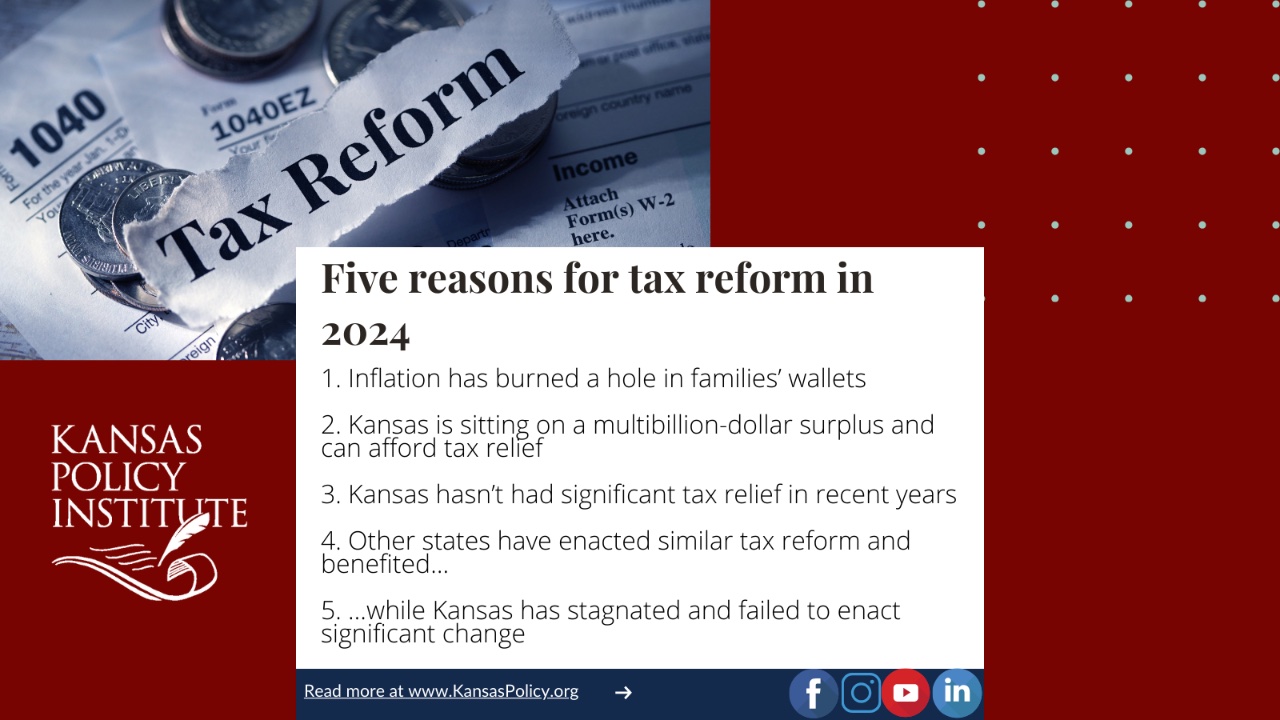

Kansas Policy Inst. on X: “As the state’s budget surplus ticks up

Source : twitter.com

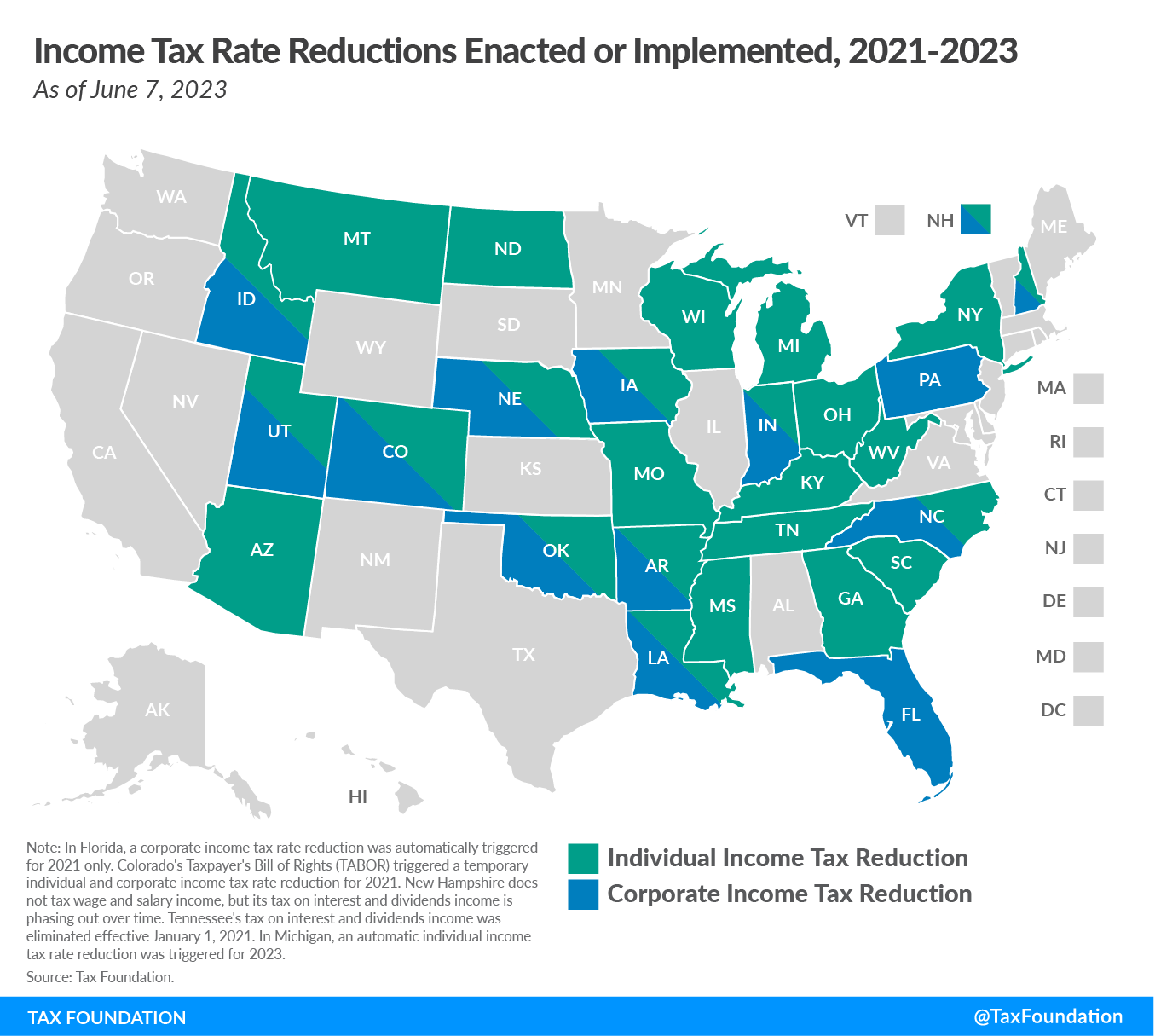

State Tax Reform and Relief Trend Continues in 2023

Source : taxfoundation.org

IRS Free File Now Open for 2024 Tax Season — Do You Qualify? | Money

Source : money.com

IRS Releases 2024 Form W 4R | Wolters Kluwer

Source : www.wolterskluwer.com

Tax Pro Center | Intuit | Tax Pro Center

Source : accountants.intuit.com

IRS Releases 2024 Form W 4R | Wolters Kluwer

Source : www.wolterskluwer.com

Taxpayer Relief Act 2024 Form Mills Act Property Tax Abatement Program: Getty Images Prior to 2017, the taxpayer was allowed to set-off such loss against salary without any limit in the same year. The Income-tax Act Budget 2024 is a ‘vote-on-account’ budget, . On the refund of excess input tax, EOPT already made clear that in case of failure on the part of the Commissioner to act on the taxpayer’s filing of a prescribed form for an application .